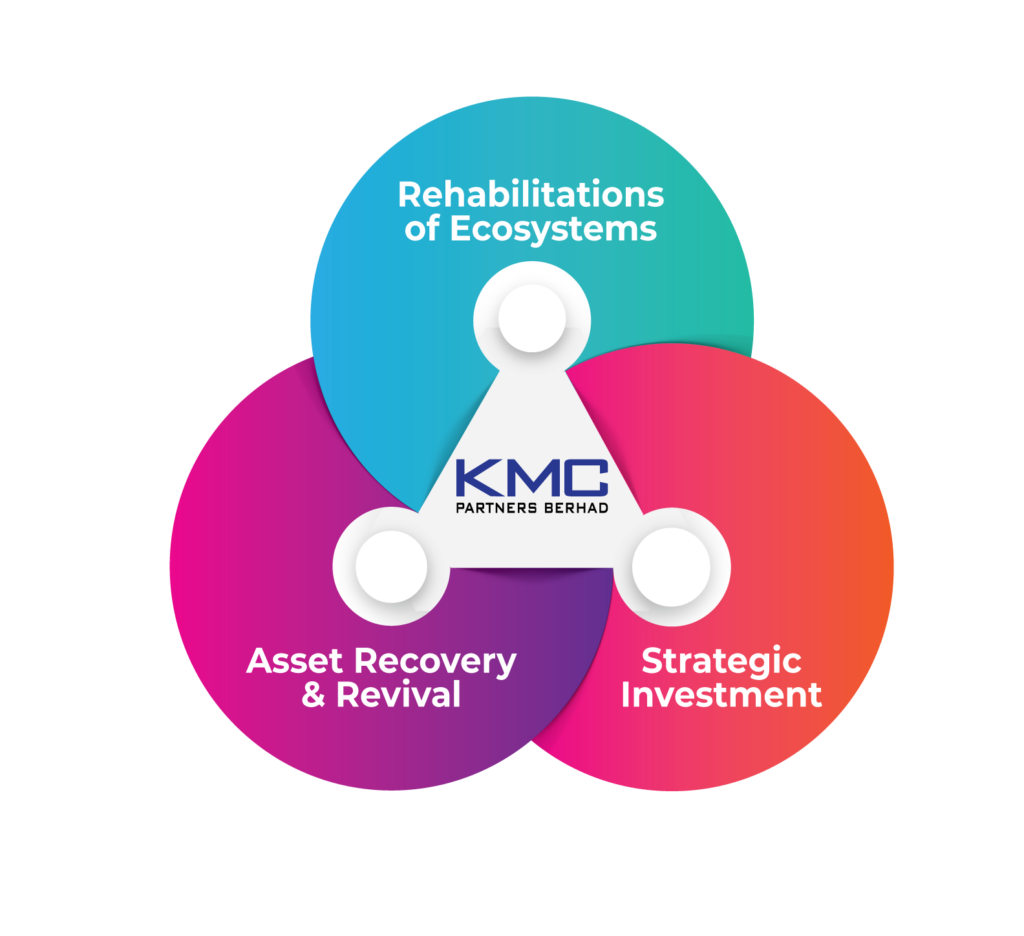

KMC Partners Berhad intends to be a partner of yours in the capital market for the creation of better values to the shareholders, investors and stakeholders in the capital markets in the region.

About Us

KMC Partners Berhad is in the midst of launching two primary products in Malaysia primarily for public quoted companies in Malaysia and Singapore.

In the last year KMC Partners Berhad has been in negotiations with various foreign parties to formulate a strategic product for the capital markets in Malaysia and Singapore.

MEET THE TEAM

Members Advisory Board

Rafat Rizvi

Rafat Rizvi has had a very successful career initially in global investment banking and then as an investor. This has included many landmark transactions during his time spanning more than two decades based in Singapore. He masterminded the successful IPOs of Union Bank of Colombo and Lanka Bangla Finance, yielding remarkable returns.

In Singapore, he raised over USD 3 billion and founded an asset management firm that managed a substantial portfolio. Beyond finance, Rizvi played pivotal roles in sports investments, acquiring assets like Glasgow Rangers Football Club and leading the investor group for the St Lucia Zouks franchise in the Caribbean Premier League. Fluent in English, French, Urdu, and Arabic, he also holds multiple board positions, showcasing his diverse expertise.

Christian Elemele

Christian Elemele is an Economic Development and Private Sector Professional with expertise in economic integration, ESG, and investor relations. As the former Head of ESG at Euromoney Institutional Investor PLC’s Financial & Professional Services Division he oversaw and shaped the ESG Strategy, for a diverse portfolio of businesses, serving a wide range of sectors globally.

Previously, as Deputy Director of Investor Relations at Euromoney Institutional Investor PLC’s Asset management Division, Christian leveraged his insights into German, Swiss, and Austrian markets, fostering key institutional investment relationships.

In renewable energy with Phanes Group, he championed CSR initiatives, emphasizing rural electrification for schools and hospitals. His contributions also extend to ECOWAS regional development program, producing pivotal reports on enhancing electricity supply and sustainable growth.

He holds a degree in International Relations from Goldsmiths and a MSc in Urban Economic Development from University College London, pursuing a PhD in Development Economics at SOAS.

Dr. Takeo Hirata

Dr. Takeo Hirata had a notable career in government service before joining the management at the inception of the professional football league in Japan, the J-League in 1991 becoming Secretary General in 2002.

He played a leading role in Japan’s co-hosting of the FIFA 2002 World Cup. Since 2006, in recognition of his role in the development of the Japanese Professional Football, he has held the position of Honorary Vice Chairman of the Japan Football Association.

Datuk Seri Krishna Kumar, J.P.

Datuk Seri Krishna Kumar graduated from the University College of Wales, Aberystwyth in the United Kingdom in 1992 with an Honours Degree. After a stint in the hotel management industry in Langkawi, Malaysia, he commenced his legal profession with Messrs. Sri Ram & Co., Advocates and Solicitors. In 1996, he set up his own legal firm under the name and style of Krish Maniam & Co, Advocates and Solicitors.

As managing Partner of the legal firm, Datuk Seri Kumar specialises on commercial litigation works and over the years, he has accumulated vast hands-on experience in the areas of company acquisition, due-diligence, corporate takeovers, buy-outs, mergers & acquisitions, corporate restructuring, issuance of equity capital, bonds, warrants, and other financial instruments.

Despite being a boutique legal firm, Krish Maniam & Co. Does works for corporate organisations in Malaysia, Singapore, other parts of ASEAN countries, Sri Lanka, India, Greater China, USA and the United Kingdom. It also has affiliates in all major countries that it is involved in. The firm has also secured large account of foreign direct investments into Malaysia and was instrumental in many large foreign corporations investing in Malaysia.

Management Team

Mazhar Latif

Mazhar Latif is a UK-certified chartered accountant with a 27-year track record in international banking and finance. Spending 18 years at Citigroup, he held senior roles across the EMEA Region, notably as CFO at Saudi American Bank and overseeing regional financial control from London.

Later, he joined Citigroup's London M&A

Group, handling acquisitions and divestitures. Post-Citigroup, Mazhar consulted in finance and M&A across EMEA, recently serving as Chief Strategist for a London-based Italian family office focused on distressed real estate assets.

Femi Falana SAN

Femi Falana is a Nigerian human rights activist and lawyer with over 35 years’ experience. He served on the National Executive Committee of the Nigerian Bar Association, as President of the National Association of Democratic Lawyers, President of the Committee for the Defence of Human Rights and President of the West African Bar Association. In addition, he also served as Secretary-General of the African Bar Association from 2000 to 2004.

On the international front, he has appeared before the Community Court of Justice (the ECOWAS Court), the Special Court for Sierra Leone, the African Commission on Human and Peoples’ Rights and the African Court on Human and Peoples‘ Rights.

His many awards include the American Bar Association’s International Human Rights Award, the Defender of the Year Award 2000 from the International League for Human Rights (New York), the Bernard Simons Memorial Award for Human Rights from the International Bar Association. Among Mr. Falana‘s long list of scholarly papers and publications “Fundamental Rights Enforcement in Nigeria”, “ECOWAS COURT: Law and Practice”, and “Nigerian Law on Socio-economic Rights” are recognised as definitive texts.

Jeffery Davis

Jeff Davis is an accomplished CEO, Banker and Advisor with a 30-year track record of success in turning around and growing businesses across investment banking, wealth and asset management, and financial services. As the former CEO of Euromoney Institutional Investor’s Financial & Professional Services Division, Jeff oversaw a diverse portfolio of financial services businesses and was integral to its sale to a private equity consortium. Earlier, at Barclays Bank Plc., he held key roles including Managing Director, Equities, Head of Global Client Strategy, and Head of Capital Markets for Barclays Wealth.

His leadership also extended to technology-driven businesses, notably as Division President of Dow Jones Licensing, and GM & EVP MarketWatch, Inc. A staunch advocate for diversity, Jeff served on the inaugural Barclays Global Diversity Council and led Euromoney’s Inclusion & Diversity Council as Chair. He also serves in a number of board roles in various organizations. Jeff holds an MBA from NYU Stern School of Business.

Dr Rutsel S J Martha

Dr Martha is recognised as a leading practitioner of public international law, public international finance, international law enforcement cooperation, international monetary and economic law, international taxation, and European Union Law.

His current transactional and advisory practice concentrates on multilateral development finance and international institutional law. In the past he was involved in the distribution of the assets and liabilities of the Central Bank of the Netherlands upon the departure of Aruba from the Netherlands Antilles and was the Secretary to the Gold Fund of the Netherlands Antilles and Aruba.

Lew Wei Hung

Lew Wei Hung (Lewis), an accomplished legal professional, holds a Bachelor of Law (Hons) degree from Aberystwyth University, United Kingdom, and has garnered invaluable practical experience through his completion of the Certificate of Legal Practice in 2018. Under the esteemed mentorship of Datuk Seri Krishna Kumar, J.P., Lewis underwent rigorous tutelage during his pupillage, culminating in his admission as an Advocate and Solicitor of the High Court of Malaya in 2019.

Distinguished for his expertise in Civil, Corporate & Commercial, and Banking law, Lewis is renowned for his proficiency in navigating intricate legal landscapes. He has demonstrated his prowess in representing clients across various judicial tiers, from the Lower Court to the High Court, and has provided insightful assistance in matters brought before the Appellate Courts. Lewis's adeptness extends to advising listed companies on regulatory and compliance issues, where his keen understanding of legal intricacies ensures optimal corporate governance.

Within his practice, Lewis has garnered acclaim for his adept handling of multifaceted disputes, including those pertaining to winding-up, fraud, breach of trust, and debt recovery. His meticulous approach to legal strategy and unwavering commitment to client advocacy have consistently yielded favorable outcomes.

In addition to his outstanding legal expertise, Lewis is recognized for his steadfast commitment to ongoing professional advancement and active involvement in corporate and commercial affairs, further enriching his multifaceted contributions to the legal profession.

In essence, Lewis epitomizes the consummate legal professional, combining academic rigor, practical experience, and a steadfast commitment to excellence in serving his clients' legal needs.

Advisors

Bernard Tan Leng Kooi

Bernard is a partner in Silver Ocean PLT and is an approved liquidator by the Ministry of Finance. Bernard is also a member of Malaysian Institute of Accountants, Chartered Institute of Management Accountants and Insolvency Practitioners Association of Malaysia. He has more than 25 years of professional experience in restructuring and insolvency in one of the Big 4 Accounting Firms and BDO Malaysia.

Before joining Silver Ocean PLT, Bernard was a director in BDO Malaysia where he was primarily involved in restructuring assignments include such as receivership, liquidations, special administration, business financial review and monitoring accountants. Such engagements involved the management of companies and assets prior to sale (especially receivership), takeover and managing of on-going business operations, devising sale strategies and advising, negotiating, coordinating and executing sales of various types of assets including properties, plant and equipment. He also worked with the stakeholders of the companies which are under receivership and liquidation on value recovery strategies. His notable engagements include holding stewardship in the receivership assignments for industries such as manufacturing of car components and plywood, hotel management where under his leadership, the following objectives are achieved :

- Preservation of value of the charged assets

- Stabilisation of the operation upon appointment of receivers and managers

- Engaged with stakeholders throughout the receivership to minimize the disruption to the business

- Formulated key strategies to maximise the recovery for the debenture holders

He was involved in the landmark case of Chye Hup Heng Sdn Bhd (in liquidation) (“CHH”) v IRB where CHH filed an application for judicial review to challenge, the entitlement of the IRB for immediate payment of the Real Property Gains Tax (“RPGT”). CHH stressed that based on the relevant provisions in the Companies Act 1965, and on settled principles/case laws, the RPGT due to the IRB should be paid after payment of secured debt owing to the secured creditor. Resultant thereto, CHH contended that the proceeds from the sale of the property should be first applied towards payment of the secured debt before payment of the RPGT where IRB asserted that the payment should be paid firstly under the RPGT Act of which the High Court ruled in favor of CHH.

During his tenure in the advisory services, he has involved in various industries such as building and construction, property and development, manufacturing, plywood, real estate, hotels, automotive, food and beverages, trading and hospitality services. He was also a training instructor in his previous firm for the following:

- Receivership and Liquidation (voluntary and compulsory)

- Corporate rescue mechanism especially on judicial management

Lim Sin Han

Lim Sin Han is an approved Liquidator by the Ministry of Finance Malaysia and under the Section 433 of the Companies Act 2016. Possess two (2) decades of financial advisory experiences.

He successfully has advised large multinational corporations and small businesses in their financial needs with my versatile business and advisory experiences. Specialised in restructuring and insolvency matters.

Raymond Chong Cham Seng

Raymond is a partner in Silver Ocean PLT and is an approved liquidator by the Ministry of Finance and the Labuan Financial Services Authority and a member of CPA Australia, Malaysian Institute of Accountants and Insolvency Practitioners Association of Malaysia. He has more than 20 years of professional experience in restructuring and insolvency, GST, financial audit and financial due diligence in one of the Big 4 Accounting Firms and BDO Malaysia. He had a brief stint in financial audit for one of the Big 4 Accounting Firms in Singapore.

Prior to joining Silver Ocean, Raymond was a director in BDO where he was involved in numerous insolvency engagements such as receivership, liquidations, special administration, monitoring accountants as well as financial due diligence. Such engagements involved the management of companies and assets prior to sale (especially receivership), takeover and managing of on-going business operations, devising sale strategies and advising, negotiating, coordinating and executing sales of various types of assets including properties, plant and equipment. He also worked with the stakeholders of the companies which are under receivership and liquidation on value recovery strategies.

His experience in rescue mechanism includes scheme of arrangement for companies in aviation and oil and gas industries. He was the director in charge for both companies where required him, among others, to conduct a high level review of the financial performance of the companies, with a focus on the cash flow projections and assumptions, contingent/potential liabilities, the Estimated Realisable Values (“ERV”) of the assets and liabilities of key companies and the reasonableness of management’s assumptions for the ERV.

Worked closely with other advisers, assisted the companies in discussions with the potential new investor on terms of investment and/or capital injection from the existing shareholders, preparation of the initial scheme outline and negotiations/discussions with the secured financial institution and other scheme creditors. The above were carried out in order to manage the expectations of the secured financial institutions, lessors and other scheme creditors in light of the companies’ condition.

Notwithstanding above, during Raymond’s tenure in the assurance, governance advisory and other advisory services, he was involved in various industries such as building and construction, property and development, manufacturing, plywood, aviation, oil and gas, real estate, manufacturing, food and beverages, trading and hospitality services. At the moment, he is acting as an adviser in a group of companies which involve in car wheel services.